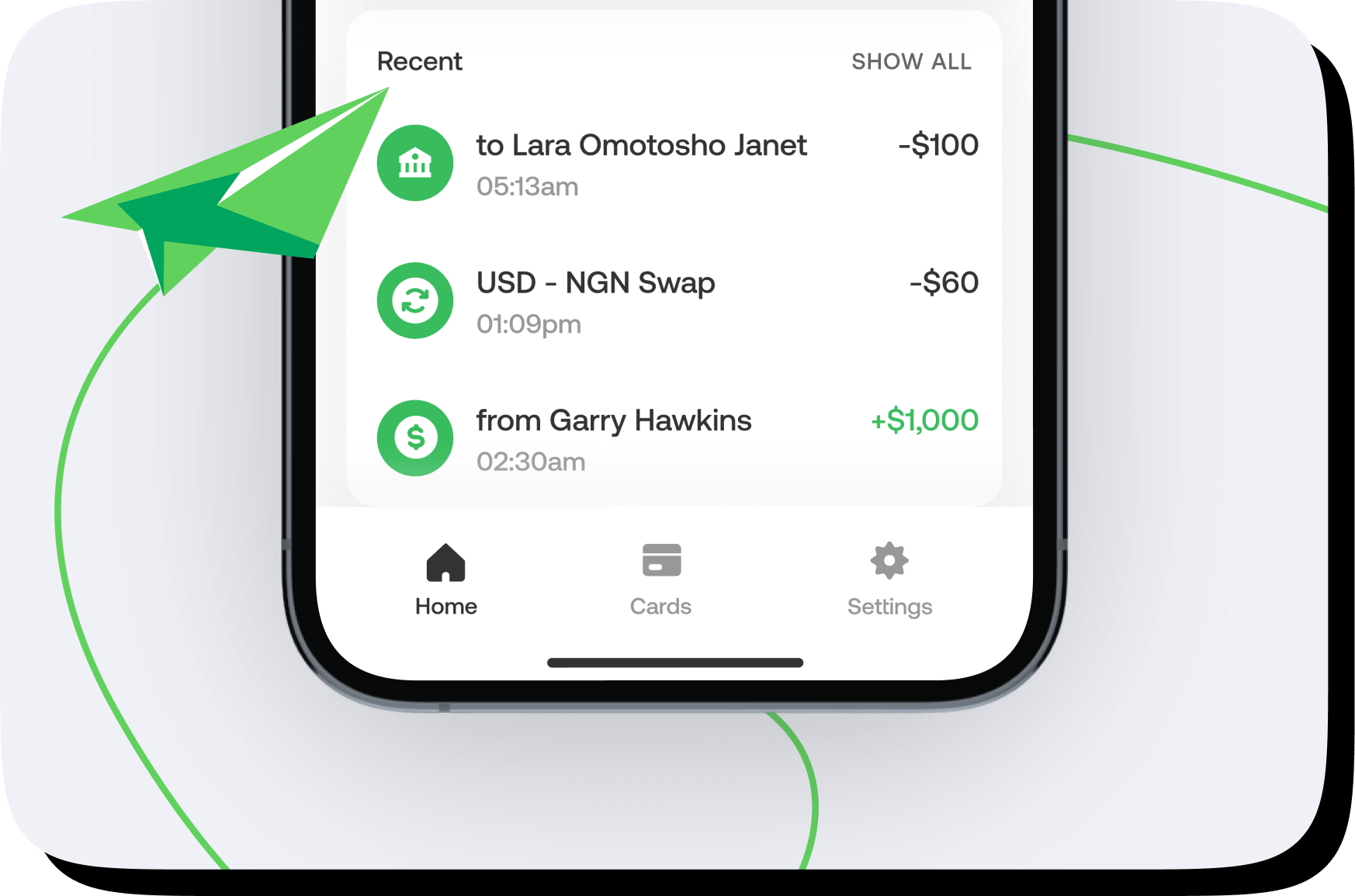

Send

Send & receive money globally

in seconds.

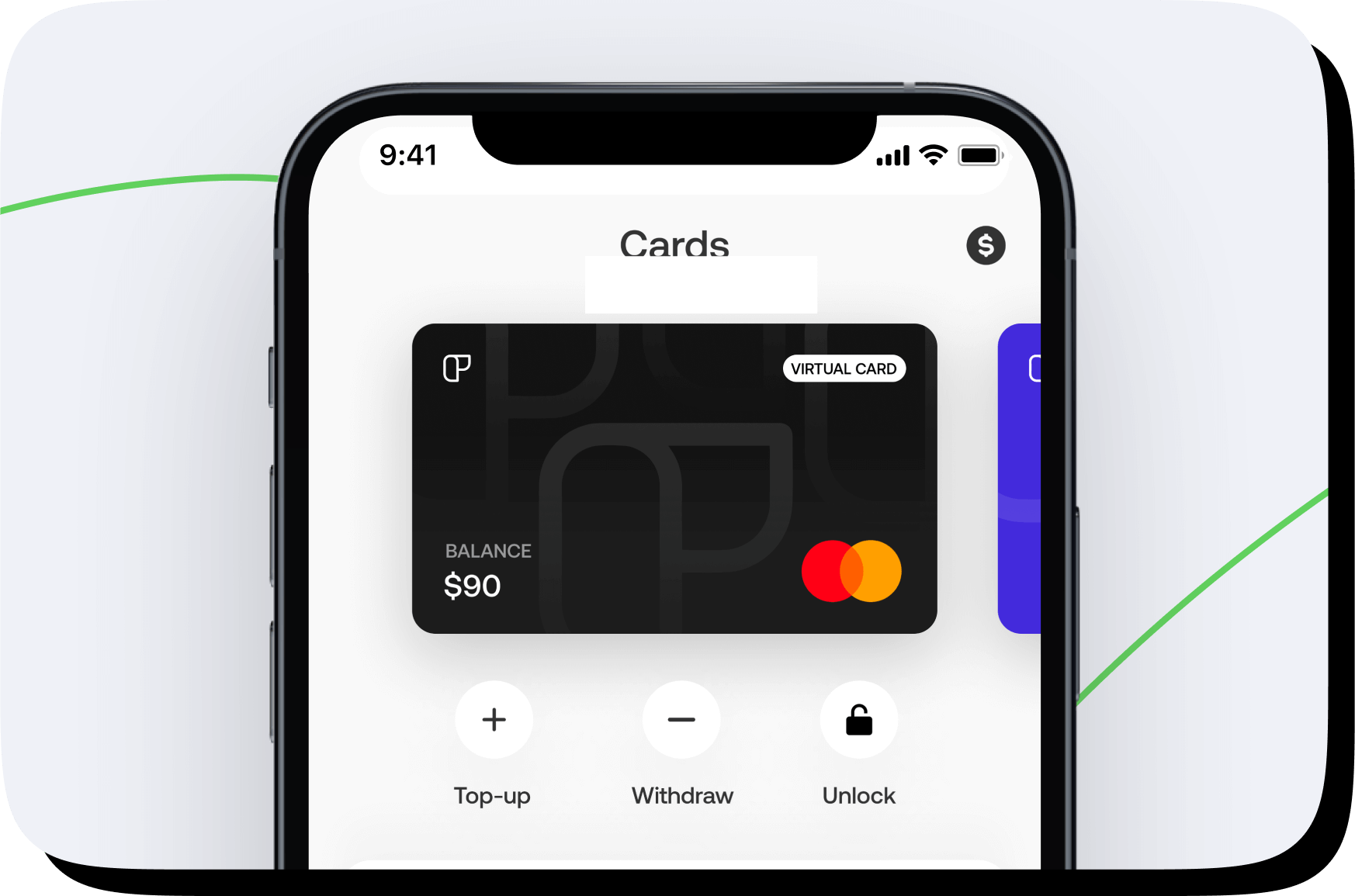

Spend

A virtual Mastercard that fits

your online lifestyle.

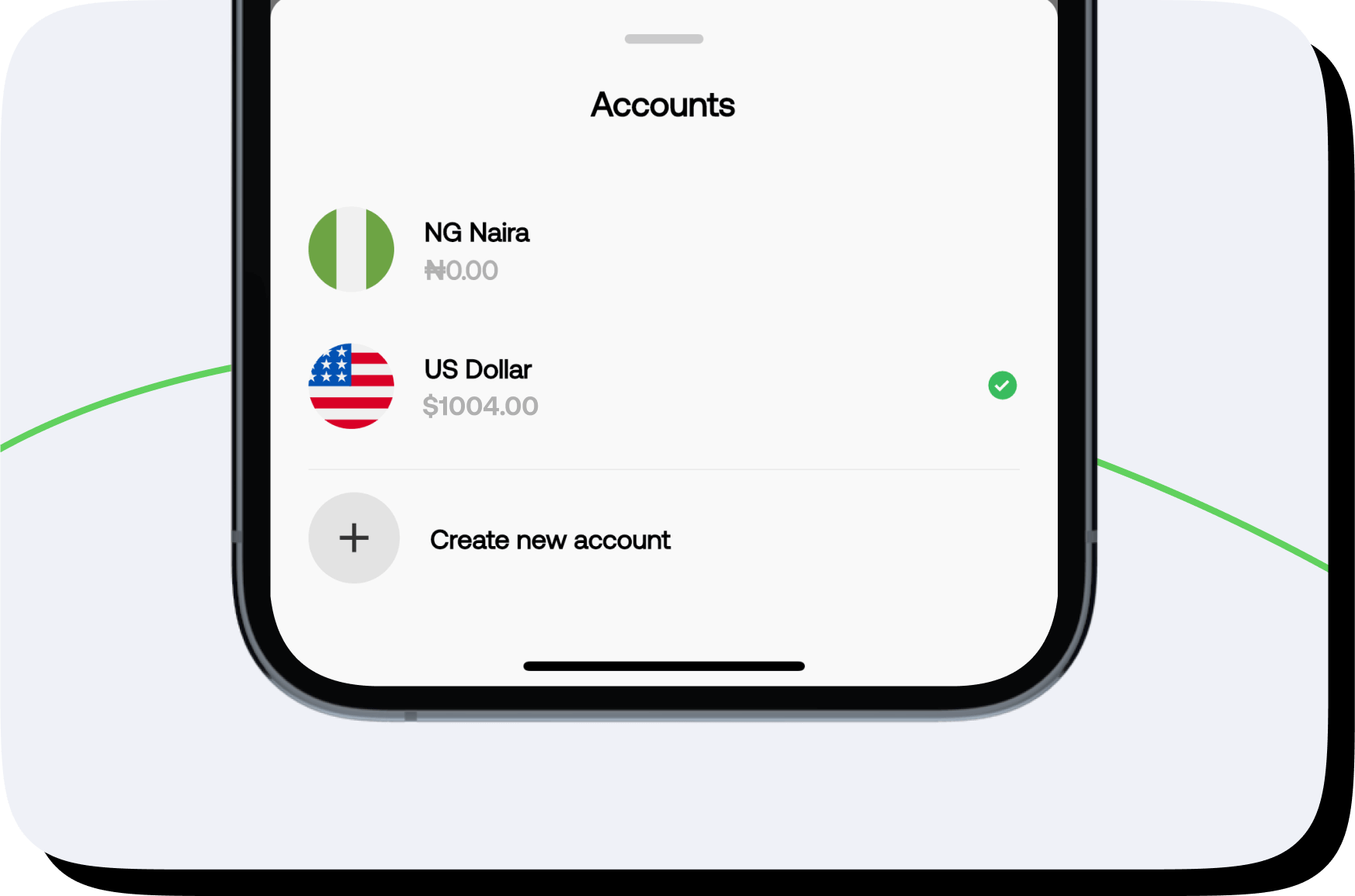

Bank

Own multiple global accounts

in your name.

USD, GBP & EUR bank accounts for free

Receive payments from your employers, clients, social media platforms, and other businesses directly to your own foreign account – without hidden fees

Global

Mastercard

Spend worldwide with your brand new virtual or physical Mastercard debit card.

Send cash to family & friends

Who remembers long account numbers anymore? Just use the Payday $tag

Get paid by foreign employers

Freelancer, remote worker or corporate employee? Get paid fast and securely!